EU–US Rift Deepens Over Greenland: Emergency Summit, Trade Retaliation Talk, NATO Consultations

A sharp EU–US rift over Greenland has emerged after President Donald Trump tied the territory dispute to the threat of additional tariffs targeting several European countries. In response, EU leaders are preparing an emergency summit in Brussels to forge a unified position and assess trade retaliation options, from counter-tariffs to stricter limits on U.S. access to parts of the EU single market. NATO has also been drawn into the Greenland standoff, holding Brussels consultations to prevent the political confrontation from spilling into the alliance’s wider security agenda.

Brussels convenes an emergency summit to prevent a fragmented response

The EU is treating the episode as a strategic test, not a temporary flare-up. Denmark sits at the center of the dispute as an EU member state, while Greenland remains an autonomous territory within the Kingdom of Denmark. That structure immediately elevates the issue for Brussels: it touches solidarity within the bloc, the credibility of Europe’s stance on territorial integrity, and the EU’s ability to react quickly when political outcomes appear to be pursued through economic pressure.

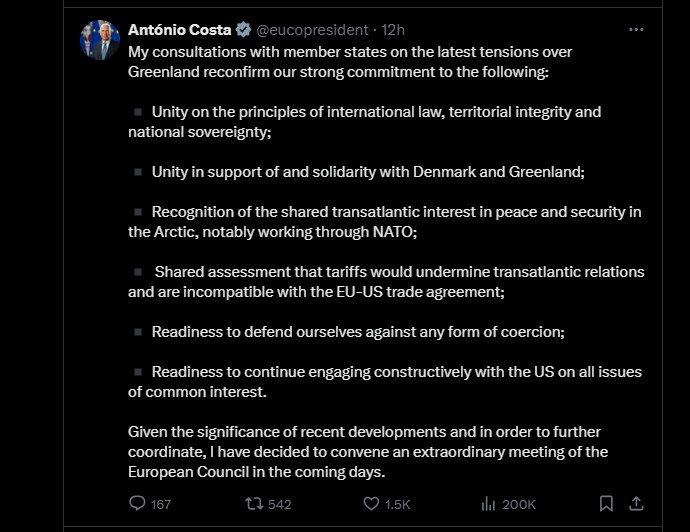

European Council President Antonio Costa has said leaders will meet “in the coming days” in Brussels. In parallel, ambassadors and senior officials from all 27 member states have accelerated consultations to align messaging and map response options before tariff timelines become binding. The immediate priority is to avoid divergence among member states with different exposure to U.S. trade, different domestic political constraints, and different appetites for escalation.

Greenland’s Arctic significance adds urgency. The region’s security environment, infrastructure routes, and potential resources have increased Greenland’s strategic visibility, meaning any suggestion that sovereignty arrangements might be negotiated under tariff threats is viewed in Europe as a precedent with wide geopolitical implications.

Trump’s Greenland demand and tariff threats push the dispute into the economic arena

The confrontation has intensified because Trump linked Greenland-related demands to an explicit tariff escalation path. Public reporting has described the demand in stark terms—an expectation of a sweeping arrangement over Greenland, framed as a “full and complete sale”—backed by trade penalties if the White House does not see progress.

Accounts cited in international coverage have pointed to an initial tariff step of 10% from 1 February, with the possibility of rising to 25% from 1 June if no agreement is reached. The scope of threatened measures extends beyond Denmark and reportedly includes several allied European countries—Germany, France, the United Kingdom, the Netherlands, Norway, Finland, and Sweden—suggesting a strategy designed to widen economic impact across multiple capitals and raise the political costs of resistance.

Greenland has repeatedly indicated it does not want to become part of the United States. This position introduces an explicit self-determination dimension into a dispute otherwise dominated by strategic arguments. Given Greenland’s small population and strong sensitivity to external decision-making, any outcome perceived as transactional would carry significant political and reputational costs.

Trade retaliation talk: Europe debates tariffs and single-market leverage

EU discussions have moved rapidly into deterrence logic: if Washington applies economic pressure, Europe may respond with economic instruments. Two broad options have taken shape in consultations.

The first is a counter-tariff package targeting U.S. imports, with figures mentioned in reporting including a potential scope of roughly €93 billion. This approach would focus on conventional trade flows—goods and supply chains—and on sectors where U.S. exporters rely heavily on European demand.

The second option is more escalatory and structural: restricting U.S. companies’ access to parts of the EU single market. Unlike tariffs, which can be adjusted relatively quickly, market-access restrictions would affect the operating conditions of American firms—how they can compete, sell services, or participate in regulated segments of one of the world’s largest economic zones. Because market access is a deeper lever than border duties, even the discussion of such measures signals a higher level of seriousness.

In the background is the EU’s Anti-Coercion Instrument, designed for situations where a third country attempts to force political decisions through economic threats or actions affecting trade and investment. While the EU may not deploy it immediately, its relevance lies in the framing: Brussels can present the dispute as coercion rather than routine tariff friction, strengthening the case for collective action.

For business, the risk is that uncertainty becomes immediate cost. Tariff threats can disrupt pricing, contracts, and investment decisions, even before measures enter into force. For consumers, a tariff-and-counter-tariff cycle can translate into higher prices and renewed inflation pressure, especially in sectors with tightly integrated transatlantic supply chains.

NATO consultations: alliance management as the Arctic security dimension surfaces

As the EU focuses on political unity and trade options, NATO has been drawn into the crisis through the Arctic security framing surrounding Greenland. NATO Secretary General Mark Rutte is expected to meet in Brussels with representatives from Denmark and Greenland amid rising tensions.

Reports indicate that Greenland’s foreign minister Vivian Motzfeldt and Denmark’s defense minister Troels Lund Poulsen are expected at NATO headquarters, with no press conference announced in advance. The meeting is significant as an institutional signal: NATO is seeking to ensure that a political dispute among allies does not become a strategic fracture that undermines defense coordination, planning, and messaging discipline.

European officials have emphasized a core argument: Arctic security can be strengthened through allied cooperation within existing frameworks, without changes to sovereignty arrangements. The objective is to show that strategic goals can be addressed through coordination and commitments—rather than through territorial bargaining reinforced by trade threats.

What happens next: summit outcomes, Davos channels, and escalation scenarios

The next phase will likely unfold on two tracks. First, the EU’s emergency summit is expected to define Europe’s common negotiating posture, agree red lines, and decide whether countermeasures should be prepared for rapid deployment or held as a deterrent. Second, informal diplomacy around global venues—particularly the World Economic Forum in Davos—could provide back-channel opportunities to test compromises, soften rhetoric, and recalibrate timelines without immediate public concessions.

A controlled de-escalation scenario would likely involve separating the Greenland dispute from tariff threats, lowering the rhetorical temperature, and returning to conventional diplomatic channels. An escalation scenario would see tariffs implemented, followed by EU countermeasures that could expand beyond tariffs into market-access restrictions. Once retaliation cycles begin, they tend to build momentum: domestic politics harden positions, affected sectors lobby for protection, and compromise becomes increasingly costly.

The EU also faces a credibility test. If a territory linked to a member state can be treated as a bargaining chip in trade negotiations, Europe risks weakening the sovereignty norms it claims to defend. That reputational cost is one reason Brussels is working to present unity quickly.

Longer-term implications: a harder transatlantic baseline and a sharper Arctic contest

Even if immediate tensions cool, the episode reflects broader structural trends: the Arctic is becoming a more explicit arena of strategic competition, and economic tools are increasingly used as instruments of geopolitical influence. Greenland’s rising relevance turns the dispute into more than a bilateral argument; it becomes a test of whether sovereignty norms can be insulated from tariff leverage in an era of hardening competition.

For the EU, the crisis may accelerate debates about strategic autonomy and the bloc’s capacity to act cohesively under coercive pressure. For NATO, it raises a difficult institutional question: how to manage serious disagreements among allies without creating openings that competitors can exploit.

For now, the emergency summit, the trade-retaliation debate, and NATO’s consultations are part of the same attempt to contain escalation—while signaling that Europe is prepared to defend both its member states and the principles it says should govern transatlantic relations.